GA Hard Money Lenders: The Best Option for Fast and Flexible Real Estate Loans

The Ultimate Guide to Discovering the most effective Tough Money Lenders

From reviewing lenders' credibilities to comparing passion prices and fees, each step plays an essential role in safeguarding the finest terms possible. As you think about these factors, it comes to be apparent that the course to identifying the appropriate difficult cash loan provider is not as simple as it might appear.

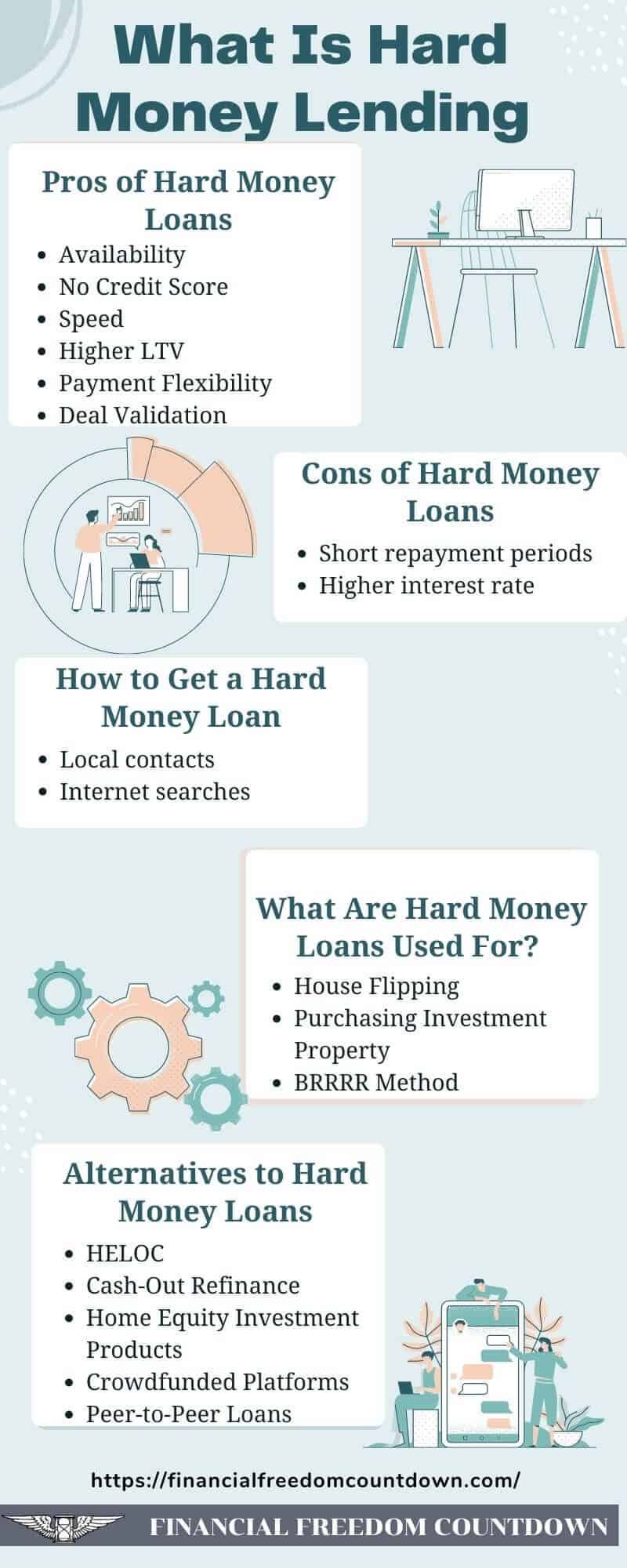

Comprehending Difficult Cash Fundings

Among the specifying functions of difficult money fundings is their reliance on the worth of the residential or commercial property as opposed to the debtor's credit reliability. This allows borrowers with less-than-perfect credit report or those looking for expedited funding to access funding extra readily. Additionally, tough cash lendings normally feature greater rate of interest and shorter payment terms contrasted to traditional fundings, showing the enhanced danger taken by lending institutions.

These lendings serve numerous functions, consisting of funding fix-and-flip jobs, re-financing distressed buildings, or giving resources for time-sensitive opportunities. Recognizing the nuances of hard cash fundings is essential for investors who intend to utilize these economic tools successfully in their genuine estate ventures (ga hard money lenders).

Secret Variables to Think About

Next, think about the terms of the financing. Various lenders offer differing rate of interest rates, charges, and settlement schedules. It is essential to comprehend these terms completely to prevent any undesirable surprises later on. Additionally, check out the lender's financing speed; a quick authorization process can be crucial in affordable markets.

An additional vital aspect is the lending institution's experience in your particular market. A lending institution aware of local problems can supply important insights and could be extra flexible in their underwriting procedure.

Exactly How to Review Lenders

Examining hard cash lending institutions includes an organized strategy to guarantee you select a companion that lines up with your investment objectives. A trustworthy lender must have a background of effective transactions and a solid network of completely satisfied customers.

Next, examine the lender's experience and specialization. Different lending institutions might concentrate on various sorts of homes, such as domestic, industrial, or fix-and-flip projects. Pick a loan provider whose knowledge matches your financial investment approach, as this expertise can considerably affect the authorization process and terms.

Another crucial aspect is the loan provider's responsiveness and communication style. A dependable lending institution needs to be accessible and ready to address your concerns thoroughly. Clear communication during the examination procedure can show how they will handle your funding throughout its duration.

Last but not least, make certain that the lender is transparent regarding their needs and procedures. This consists of a clear understanding of the documentation required, timelines, and other any problems that might apply. Making the effort to review these elements will certainly empower you to make an educated choice when picking a hard money lender.

Contrasting Rate Of Interest and Costs

A detailed contrast of rate of interest rates and charges amongst difficult cash lenders is important for optimizing your financial investment returns. Tough cash finances commonly come with greater rate of interest compared to traditional financing, commonly varying from 7% to 15%. Comprehending these prices will certainly help you evaluate the prospective expenses linked with your financial investment.

In enhancement to rate of interest, it is vital to assess the linked fees, which can considerably affect the general car loan expense. These charges may consist of source fees, underwriting charges, and closing prices, commonly shared as a percentage of the loan quantity. Origination charges can differ from 1% to 3%, and some loan providers might bill additional costs for processing or administrative tasks.

When comparing loan providers, consider the complete cost of borrowing, which incorporates both the rate of interest prices original site and costs. Be sure to make inquiries about any kind of feasible prepayment fines, as these can affect your ability to pay off the funding early without sustaining additional charges.

Tips for Effective Loaning

Comprehending interest rates and costs is only component of the formula for protecting a tough cash financing. ga hard money lenders. To guarantee effective borrowing, it is important to completely examine your economic situation and job the prospective return on financial investment. Start by plainly specifying your borrowing objective; lenders are more probable to respond positively when they understand the desired use the funds.

Following, prepare an extensive business strategy that outlines your task, anticipated timelines, and economic projections. This shows to lenders that you have a well-thought-out technique, boosting your reputation. Additionally, maintaining a solid partnership with your loan provider can be advantageous; open communication fosters trust and can bring about much more desirable terms.

It is also vital to make certain that your home meets the loan provider's standards. Conduct a comprehensive assessment and give all called for documents to streamline the approval procedure. Be conscious of exit methods to pay off the finance, as a clear payment strategy assures lending institutions of your dedication.

Final Thought

In recap, finding the most effective difficult cash lenders demands a complete examination of numerous components, including loan provider online reputation, car loan terms, and specialization in residential property types. Reliable assessment of lending institutions through contrasts of rates of interest and costs, combined with a clear organization plan and solid interaction, improves the possibility of positive borrowing experiences. Eventually, persistent research study and strategic engagement with lending institutions can lead to successful monetary results in property undertakings.

Furthermore, difficult cash financings typically come with greater rate of interest prices and go to this web-site shorter repayment terms contrasted to traditional lendings, showing the enhanced danger taken by lenders.